deadline to pay mississippi state taxes

Ad Valorem Tax Renditions Personal property tax renditions shall be filed with the local county tax assessors on or before April 1. The Mississippi Department of Revenue has extended the states filing deadline for.

2022 State Tax Reform State Tax Relief Rebate Checks

The deadline to file and pay 2019 Mississippi individual and corporate income taxes has been extended to May 15.

. Mailing addresses are listed below - is October 15 2022 October 17 2022. The MS tax deadline coincides with the federal tax deadline which typically is on April 15 unless it falls on a weekend or deemed otherwise by the IRS. Mississippi State Taxes information registration support.

The payment deadline to avoid penalties and interest on 2019 personal c orporate and fiduciary income tax returns is april 15 2021. Property tax deadline passed in Mississippi August 23 2018 WINSTON COUNTY Miss. Step-by-step guidance to help you quickly prepare and file your 2021 tax return.

Mississippi will follow the extended federal due date and eligible taxpayers will now have until February 15 2022 to file returns and pay any taxes that were originally due between August 28 2021 and February 15 2022. Tax Day in Mississippi is normally April 15 but this date falling on a weekend moves the deadline to April 18 2022. Ad New State Sales Tax Registration.

Mississippi residents now have until May 15 2020 to file their state returns and pay any state tax they owe for 2019. The state Department of Revenue said Wednesday that July 15 is the new. The new due date for filing income tax returns is July 15 2020.

Mississippi Storm and Flooding Relief. The Mississippi Department of Revenue announced today that it will push back its tax filing deadline in the wake of the coronavirus pandemic. How to Make a Credit Card Payment Income Tax Estimate Payments You can make Estimate Payments through TAP.

If you are receiving a refund. For all affected taxpayers the due date for making 2019 state income tax payments due from april 20 2020 to. The state tax filing and payment deadline as well as deadline to pay 2021 estimated income taxes has been moved to June 15 2021 after many were impacted by winter storms in February.

All other income tax returns. The extension applies to individual income tax returns corporate income and franchise tax returns and fiduciary income tax returns. MS individual income tax returns are due by April 15 in most years or by the 15th day of the 4th month following the end of the taxable year for fiscal year filers.

Taxpayer Access Point TAP Online access to your tax account is available through TAP. WLBT - Mississippi Department of Revenue announced an extension to tax filing. Failure to meet this deadline results in a mandatory 10 penalty per Miss.

If you want to make sure your MS taxes were paid you can do so in a number of ways. There is an additional convenience fee to pay through the msgov portal. There is no fee.

Optionally the eFileIT deadline is. WCBI If youre a property owner in Mississippi its time to pay up. The state allows you to request an extension of time to file your return.

Select Make an Estimated Payment from the left hand menu. The deadline to settle up for delinquent. Find the Right Tax Relief Plan that Suits Your Needs Budget.

Mississippi code at lexis publishing. Ad You Can Begin Your 2021 Tax Return Today Even Though the Deadline is Past. Mississippi has extended the due date for filing income tax returns from April 15 2020 to May 15 2020.

This extension applies to Individual Income Tax returns Corporate Income and Franchise Tax returns and Fiduciary Income Tax returns. Ad Click Now Compare 2022s 10 Best Tax Relief Program. 27-31-55 requires free port warehouses to file inventories.

You must file your return and pay any taxes due by this date. Ad valorem taxes are payable on or before February 1 following the year of assessment. Treasury Department and Internal Revenue Service recently announced that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021 and Mississippi was soon to follow.

Pay by credit card or e-check. Best Tax Relief Brands. Taxpayer Access Point Payment.

JACKSON For the second time this year Mississippi is delaying the deadline to file state income tax returns. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or eCheck. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals.

When are Mississippi State Income Tax Returns Due. Ad Valorem taxes on motor vehicles are paid at the time the vehicle is. The new deadline is May 15 a month after the traditional April 15 deadline and two months before the new federal deadline of July 15.

In a news release the DOR said it. IRS Form 4868 - 2995 Your State Extension PDF is FREE General Instructions Mississippi Filing Due Date. Deadline to pay mississippi state taxes.

Pay by credit card or. Free Port Warehouse Exemptions Miss. While this year is a bit different for most Mississippi residents Tax Day is April 15 of each year matching up with the deadline for your federal return.

Resolve Your IRS Issues Now. Deadline for taxpayers who got an automatic MS Tax Extension to file their Mississippi Income Tax Return by mail-in Forms - the Forms incl. How Do You Check The Status of Your MS Tax Refund.

Real and Personal Property Land Rolls Deadline the due date for Real and Personal Land Rolls furnished from County Tax Assessors to Boards of Supervisors has been extended for 30 days.

Mississippi State Tax H R Block

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

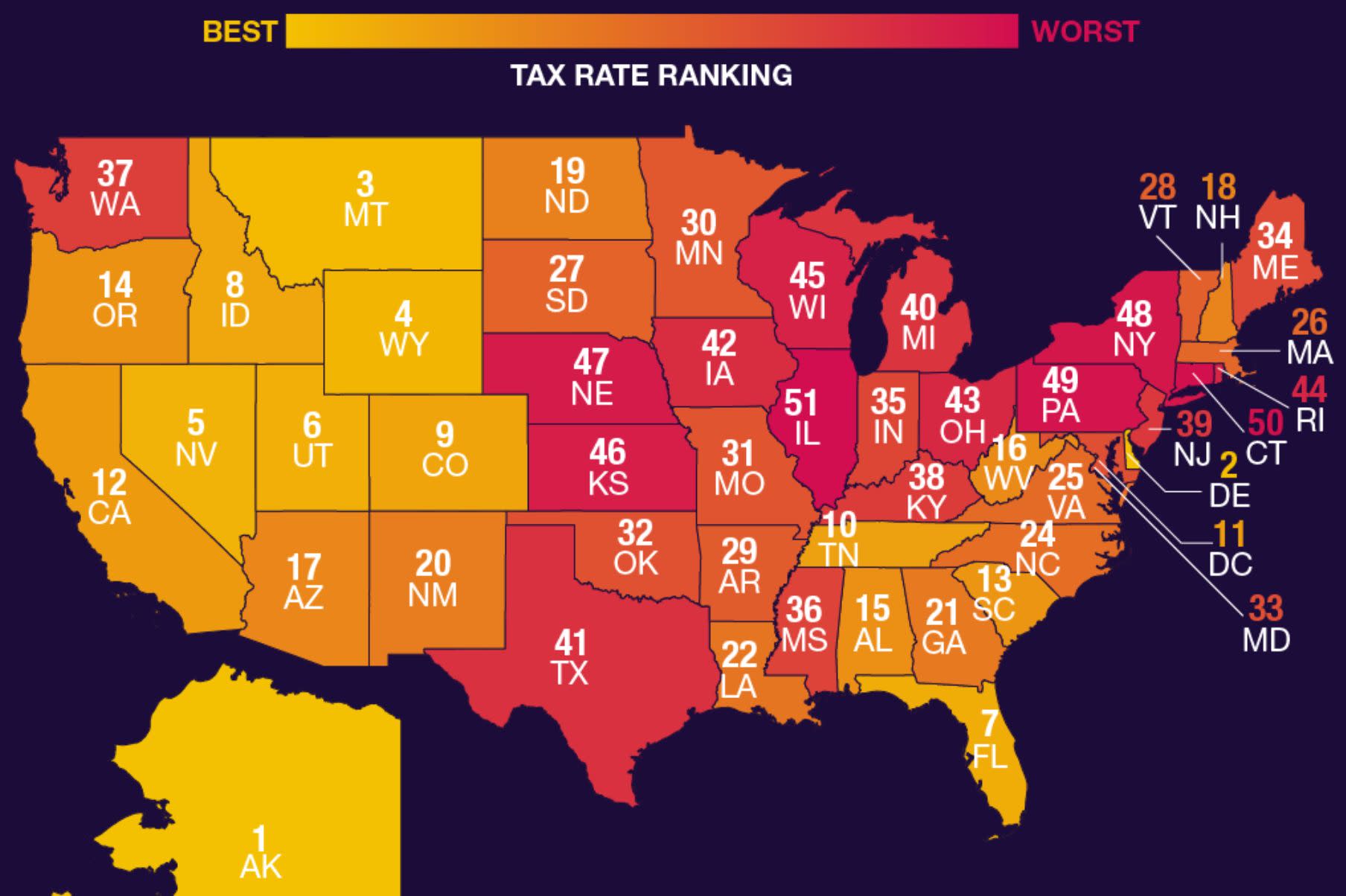

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Economic Nexus Laws By State Taxconnex

2020 Tax Deadline Extension What You Need To Know Taxact

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Top Reasons For Irs Tax Audits Irs Taxes Debt Relief Programs Tax Debt

Mississippi Sales Tax Small Business Guide Truic

The Best And Worst U S States For Taxpayers

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

2020 Tax Deadline Extension What You Need To Know Taxact

Most State Taxes Due April 17 Too

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Federal Income Tax Deadline In 2022 Smartasset

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)